Texas Border Title Loans provide a specialized financial solution for urgent needs using vehicle titles as collateral, offering quicker access to cash with higher interest rates due to their high-risk nature. Ideal for unexpected expenses or emergencies, these loans differentiate themselves from other short-term options like Semi Truck Loans or Cash Advances by leveraging vehicle equity. Maximizing these loans involves strategic allocation, such as funding business startups, education, or skill development, leading to financial stability and growth. Repayment flexibility allows borrowers to tailor plans based on unique financial situations, with various repayment methods available, including refinancing for optimized terms and reduced costs.

“Uncover the power of Texas border title loans – a unique financial solution tailored to your needs. This comprehensive guide navigates the ins and outs, offering a ‘quick view’ into how these loans work and their potential benefits.

Explore creative ways to utilize loan funds, from investing in education to enhancing business capital, maximizing impact while ensuring easy repayment strategies. Discover how Texas border title loans can be a game-changer for your financial journey.”

- Understanding Texas Border Title Loans: A Quick Guide

- Creative Ways to Utilize Your Loan Funds for Maximum Impact

- Building Financial Security: Repaying Your Texas Border Title Loan Effortlessly

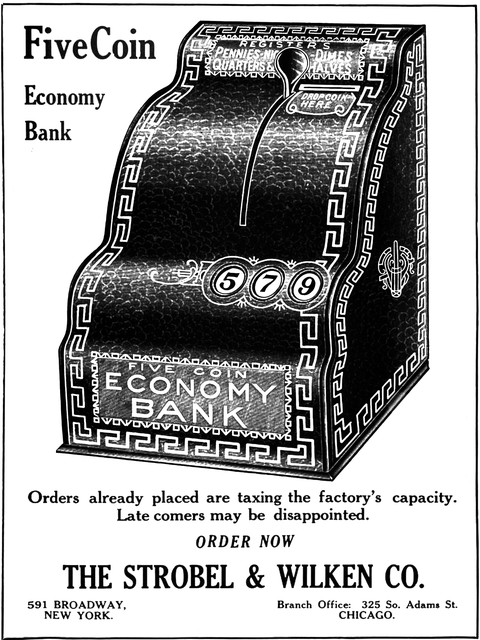

Understanding Texas Border Title Loans: A Quick Guide

Texas Border Title Loans offer a unique financing solution for residents facing immediate financial needs. This type of loan is secured against the value of a vehicle, typically focusing on personal vehicles like cars or motorcycles. The process involves using the vehicle’s title as collateral, allowing lenders to provide quick access to cash. This can be particularly beneficial for those in need of fast funding, such as covering unexpected expenses or providing relief during financial emergencies.

As with any loan, understanding the terms is crucial. Borrowers should be aware that these loans often have shorter repayment periods and higher-than-average interest rates due to the high-risk nature of the security. However, they can be a game-changer when quick cash is required, especially for those who own their vehicles outright or have minimal debt. Compared to other short-term financing options like Semi Truck Loans or Cash Advance services, Texas Border Title Loans provide an alternative with specific advantages tied to vehicle equity.

Creative Ways to Utilize Your Loan Funds for Maximum Impact

Maximizing your Texas border title loan is all about being creative with how you allocate the funds. Beyond covering immediate financial needs, consider long-term investments. For instance, if you have a business idea that requires startup capital, using part of your loan to fund it could be a smart move. This could transform your venture into a profitable enterprise, eventually paying off the loan and providing additional income.

Another innovative approach is to use the funds for education or skill development. Investing in yourself through courses, certifications, or even pursuing further education can equip you with valuable skills that enhance your employability. Secured loans like car title loans offer a safety net, ensuring you have a reliable source of income to repay the loan while also providing peace of mind. Remember, smart use of these funds can pave the way for financial stability and growth.

Building Financial Security: Repaying Your Texas Border Title Loan Effortlessly

Building Financial Security involves strategic planning and managing your money wisely. When you take out a Texas Border Title Loan, it’s essential to have a clear repayment strategy in place. One of the significant advantages of this type of loan is its flexibility. Borrowers can often tailor their repayment options to fit their unique financial situations.

By utilizing the vehicle equity, you can secure a loan with the value of your vehicle, ensuring lower interest rates and more manageable monthly payments. Repayment is effortless when you choose from various options available. Whether it’s through automatic debits from your bank account or setting up a direct payment plan, you gain control over your financial commitments. Additionally, refinancing your existing Texas Border Title Loan can provide relief if your current terms are less favorable. This process allows for better management and could potentially reduce your overall loan cost.

Texas border title loans can be a smart financial tool when used creatively. By understanding these loans and their potential, individuals can access much-needed capital for various purposes. Whether it’s investing in education, starting a small business, or securing emergency funds, strategic planning ensures the loan’s benefits are maximized. Moreover, prioritizing repayment creates a solid foundation for future financial stability, allowing borrowers to emerge from this short-term solution with enhanced economic well-being.